BECOMING AN INVESTOR

Smart Investments. Transparent Results.

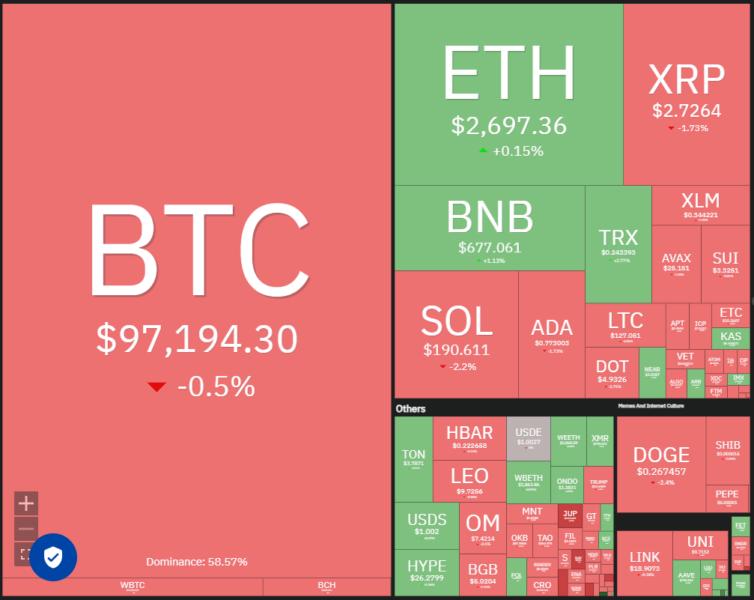

Invest with confidence through EITFM’s verified trader network. Our platform ensures transparency, risk management, and capital security while allowing you to participate in profitable opportunities across CFDs, commodities, indices, and equities.

Don’t Wait—Take the Next Step & Join Us Today!

OUR INVESTORS

Real Stories of Success

At EITFM, we empower traders with funding, mentorship, and a systematic approach to long-term success. Hear from traders who have transformed their skills, gained financial independence, and built sustainable careers through our transparent and structured ecosystem.

Total Funds Connecting & Still Counting

How to get started?

Traders begin their journey with EITFM through a personalized interview to assess their current stage and identify areas for growth. Based on the evaluation, they are paired with a mentor to meet EITFM’s requirements and standards. Once aligned, traders are connected with investors seeking reliable and disciplined professionals.

- Proven Systematic Process: EITFM offeres systematic approach minimizes guesswork and maximizes results by focusing on verified strategies and disciplined execution.

- Freedom from Investor Pressure: This eliminates the emotional burden of facing criticism or unrealistic demands, allowing traders to focus solely on their performance and growth.

- Access to Resources: Leverage advanced tools, strategies, and education tailored to improve trading performance.

- Performance Monitoring: Regular feedback and guidance to ensure discipline and long-term growth.

- Income Growth: Earn steady income through trading performance and profit-sharing opportunities.

- Discipline and Rule Adherence: Traders are expected to strictly follow the predefined trading rules and guidelines.

- Those unable to meet these standards may face termination to maintain the platform's integrity.

- Risk Management with a Systematic Approach: Traders must manage risks using a structured and proven system, ensuring controlled drawdowns and steady portfolio growth.